Convert Your Tax Dollars into Kazel Scholarship Dollars

Kazel Scholarship

Through the Ohio Association of Independent Schools Scholarship Granting Organization (OAIS SGO), Ohio taxpayers can receive a non-refundable tax credit of up to $750 (individual) or $1,500 (married couples filing jointly) on their Ohio income tax returns for monetary donations made to an eligible SGO. As a result, Urban Community School established the Kazel Scholarship. Donations designated to UCS, made through the OAIS SGO, will be directed toward the Kazel Scholarship. With 80% of our students receiving tuition assistance, access to scholarships is critical.

Ohio taxpayers can receive a non-refundable tax credit of up to $750 (individual) or $1,500 (married couples filing jointly) on their Ohio income tax return for monetary donations made to an eligible SGO.

Income of $50,000 (individual) or $100,000 (married) will generally allow you to receive the full tax credit.

For more information, contact Meredith Pacenta at 216.939.8441.

Frequently Asked Questions

General Information

What is Ohio’s new Tax Credit Program?

The Ohio General Assembly established a program whereby Ohioans can receive a 100% tax credit against Ohio income tax liability for cash contributions to certified Scholarship Granting Organizations (SGOs) that grant scholarships to students.

What is the OAIS SGO Kazel Scholarship?

The Ohio Association of Independent Schools (OAIS) consists of 43 member schools, including Urban Community School, all of which are committed to the quality of education that independent schools provide to students from diverse backgrounds. Each school is governed by an independent board with a focus on the school and education itself. Learn more here.

A Scholarship Granting Organization (SGO) is a nonprofit 501(c)(3) organization that receives contributions from donors and grants educational scholarships to eligible students in Ohio. Individuals and entities that contribute to SGOs participating in the program can receive a tax credit. The SGO program was enacted in 2021 as part of Ohio House Bill 110.

Who will benefit from the OAIS SGO Kazel Scholarship?

Urban Community School Students: Our students will benefit from this program by prioritizing scholarships for families with demonstrated financial needs who seek high-quality education opportunities for their children.

Ohio Taxpayers: Ohio taxpayers can reduce their Ohio state tax liability by making a contribution to an SGO. This is a dollar-for-dollar tax credit against your tax liability or the tax you owe to the State of Ohio.

Contributing to the OAIS SGO Kazel Scholarship

Who can contribute to the OAIS SGO Kazel Scholarship?

Anyone with Ohio tax liability may be eligible for the tax credit.

Is there a cap on the amount I can contribute to the OAIS SGO Kazel Scholarship?

The maximum credit amount is currently $750 (individual) or $1,500 (married couples filing jointly).

May I designate my contribution to a specific student?

No. As a 501(c)(3) organization, the OAIS SGO does not accept contributions that are designated for specific students.

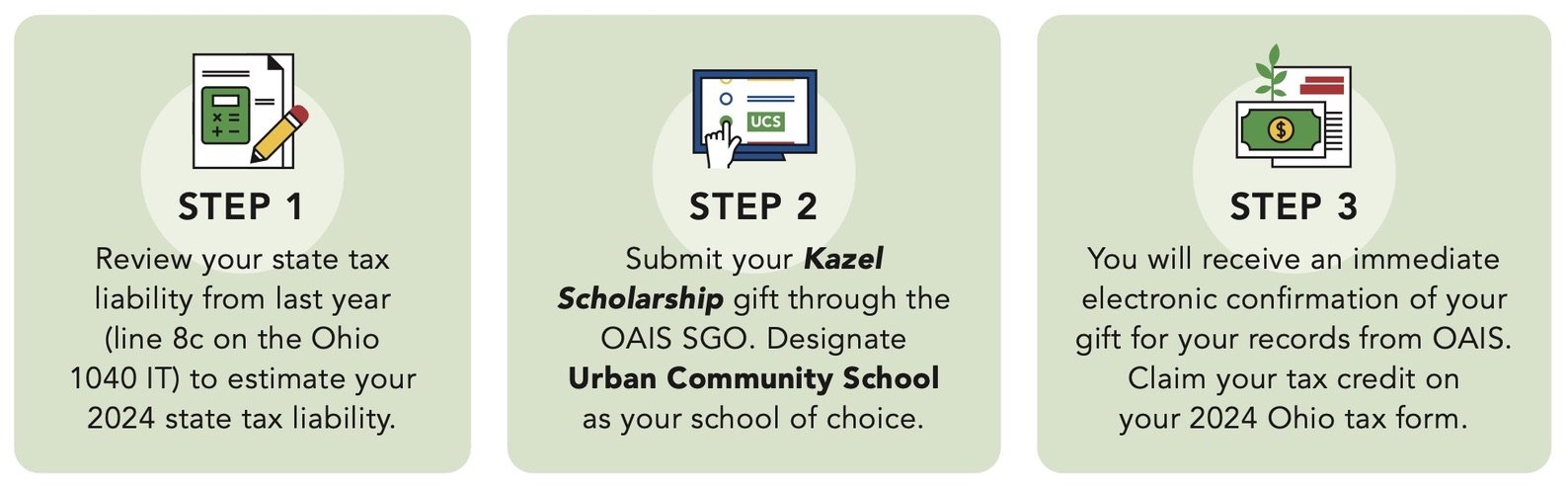

How do I complete my contribution?

The easiest way to contribute to the OAIS SGO Kazel Scholarship is by credit card with a designation to Urban Community School. Please do so here. Upon completion, you will receive an immediate electronic confirmation of your contribution for your records. The electronic confirmation you receive can be used when filing your upcoming State of Ohio income taxes and claiming your tax credit.

If you prefer to mail your check directly to OAIS SGO, please call Meredith Pacenta, Individual and Planned Giving Coordinator, at 216.939.8441.

Stock gifts are not permitted.

Tax Credit Information

The information below is general in nature and is not intended to be used as tax advice. Please consult a tax professional who is aware of your personal tax situation about this credit and your potential use of it.

Is the amount I claim a tax deduction?

Contributors to the OAIS SGO will receive a dollar-for-dollar state tax credit up to the $750 (individuals) or $1,500 (married couples filing jointly) maximum contribution, which is different from a tax deduction. Tax deductions reduce your taxable income. A tax credit is a dollar-for-dollar credit against the taxes you have paid or will owe to the State of Ohio.

How does this new tax credit allow me to GIVE $750 and GET $750?

You will claim this credit when you file your Ohio state income tax return. The non-refundable credit will reduce your state tax liability (the amount you owe in taxes). A non-refundable tax credit limits your tax benefit to no more than what you owe in taxes. The amount of the tax credit you can claim equals 100% of the amount you contribute, up to $750 per individual or $1,500 for married couples filing jointly.

How do I get a tax credit?

EASY AS 1, 2, 3:

If you have any questions please contact Meredith Pacenta, Individual & Planned Giving Coordinator, at 216.939.8441.

Learn More About Sister Dorothy Kazel, OSU

The Kazel Scholarship honors Sister Dorothy Kazel, OSU, who was an Ursuline Sister from 1960 to 1980. Sister Dorothy lived her life with great courage and vibrant faith. She was a beloved educator and dedicated missionary who served children in Cleveland and across the world, specifically in El Salvador. Sister Dorothy was martyred in El Salvador in 1980, along with three other female missionaries…an indescribable tragedy and loss to the Ursuline community.

Sister Dorothy Kazel, OSU (June 30, 1939 - December 2, 1980)

Sister Dorothy and the Ursuline Sisters’ legacy continues to live on through UCS’s core values. Through their spirit of compassion and deep commitment to children in Cleveland, we have named our program, the Kazel Scholarship.

Your gift to the Kazel Scholarship helps us to continue the work inspired by Sister Dorothy Kazel, OSU, and the Ursuline Sisters of Cleveland. This allows UCS to provide every student with a high-quality education to build a stronger future in Cleveland.